In the 90’s, my knitwear business was focused on wholesale. I had samples and I’d visit shops and take orders. It seemed like an easy-peasy business model at first; make product to order and get paid for it. What could go wrong?

Here’s the rub: For September delivery, I would get the orders in May. As soon as the order came in, I’d be paying for yarn and labour to produce the order and then I’d pay to ship it in late August.

And if I was lucky, I’d get paid in October. That’s six months or more I’m laying out cash for that order! Cashflow was so hard to manage.

If you’re running a B2B business, chances are you’ve faced this before – the cash is tight, you’ve got a great opportunity, and now you’re wondering how to get the money fast so you can make it happen!

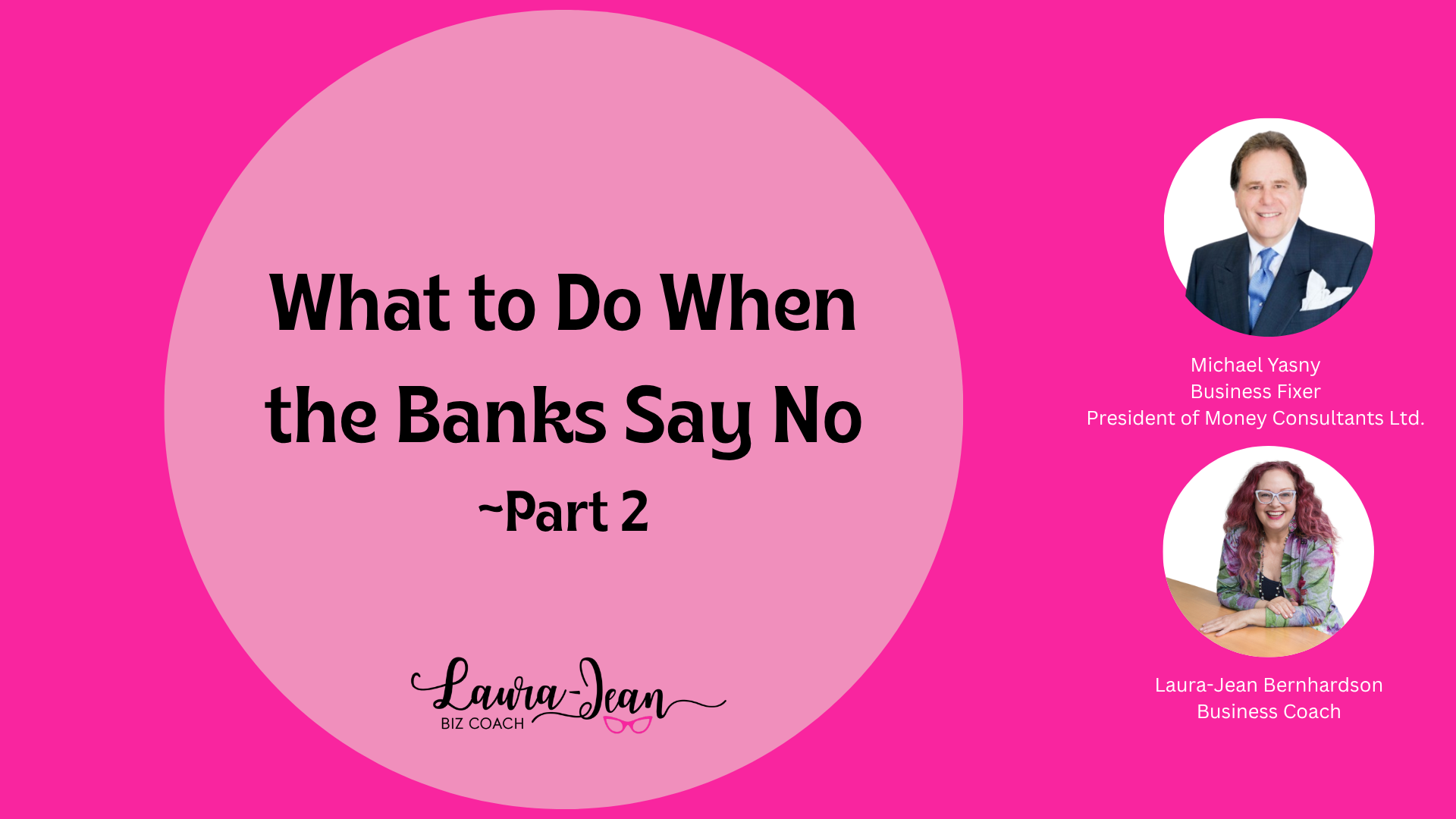

That’s why I brought back Business Fixer Michael Yasny for Part 2 of our conversation on alternative business financing. (See part 1 here)

He’s a wealth of knowledge about financing small and medium sized businesses – he’s been working in the field for over 30 years!

In this video, we talk about:

-

- Smart (and safe) ways to fund big orders

-

- Why using personal funds or family loans can be risky — and how to protect yourself

-

- The traps people fall into when they don’t understand how different forms of financing work together

Michael’s biggest advice? Talk to an expert before it’s urgent.

It’s so much better to set things up right early and head off problems before they start.

If you’re wondering whether he can help you, book a free call here: https://bit.ly/BookMichaelY